Best Time to Trade Boom and Crash for Maximum Profits

Timing is everything in trading. Learn when the markets are most active and profitable for Boom and Crash trading.

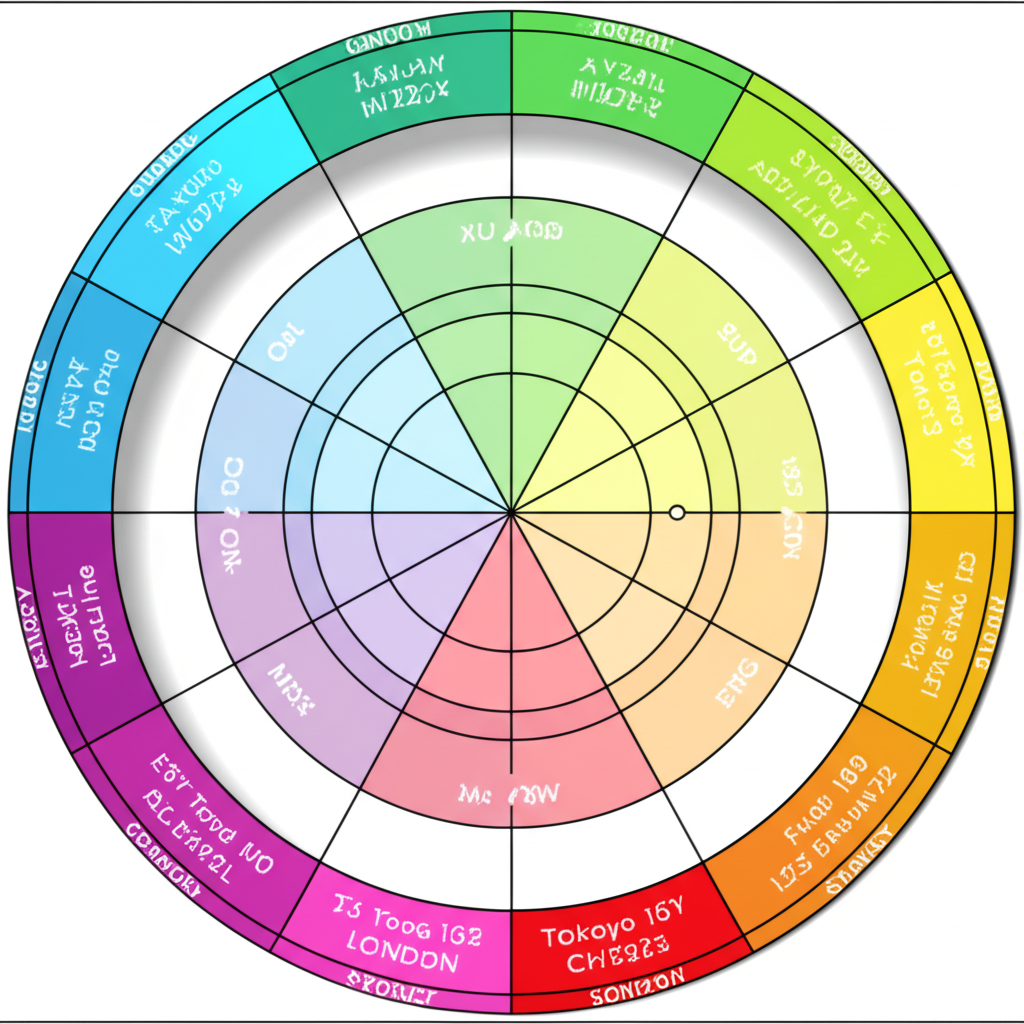

Understanding Market Hours

While Boom and Crash indices are available 24/7, certain times offer better trading opportunities due to increased volatility and volume from traditional forex markets. Understanding these patterns is crucial for implementing any effective boom and crash strategy.

Optimal Trading Sessions

Based on extensive analysis and trader feedback, here are the best times to trade Boom and Crash:

London Session (8:00-17:00 GMT)

The London session is often considered the best time for Boom and Crash trading due to:

- High market volatility

- Increased trading volume

- Clear trend formations

This session is particularly effective for the 1-minute trading strategy due to the increased price action.

New York Session (13:00-22:00 GMT)

The New York session overlaps with London for several hours, creating excellent trading conditions with strong directional moves. This is when many of the professional trading techniques work best.

London-New York Overlap (13:00-17:00 GMT)

This 4-hour window is considered the golden time for Boom and Crash trading, offering the highest probability setups. It's ideal for implementing strategies from our comprehensive 2025 strategy guide.

Times to Avoid Trading

Certain periods are less favorable for trading:

Asian Session (22:00-8:00 GMT)

Generally quieter with less volatility, making it harder to find good trading opportunities. However, some traders find success with specific variant-specific strategies during these hours.

Weekend Gaps

While Boom and Crash trade continuously, the first few hours after traditional forex markets close on Friday can be unpredictable.

Impact of Economic News

Major economic announcements can affect Boom and Crash indices indirectly. Key events to watch:

- US Non-Farm Payrolls (First Friday of each month)

- Federal Reserve meetings and announcements

- Major central bank decisions

Set up automated trading signals to alert you when these events approach.

Seasonal Trading Patterns

Some traders have observed seasonal patterns in Boom and Crash behavior:

- Higher volatility during the first and last weeks of the month

- Reduced activity during major holidays

- Increased volatility during quarterly earnings seasons

Practical Trading Tips

To maximize your trading success:

- Use an economic calendar to track major news events

- Start with smaller position sizes during unfamiliar time periods

- Keep a trading log to identify your most profitable trading times

- Consider your personal schedule and trading style

For beginners, start by reading our complete guide to boom and crash trading to understand the fundamentals before focusing on timing.

Ready to Put This Strategy Into Practice?

Start trading Boom & Crash with Deriv - the world's leading synthetic indices platform

👉 Start Trading with DerivAbout FrankFX

Professional trader with over 5 years of experience in Boom & Crash trading. Sharing proven strategies and insights to help traders achieve consistent profits.